A ticking tax time bomb? What your clients need to know about the SECURE Act and inherited IRAs

Imagine you’re in the middle of playing an intense game of baseball. Both teams are tied in the bottom of the ninth inning. You’re on the mighty home team, and you have a runner on third base, eagerly waiting to score. There’s only one out.

Then all of a sudden, the umpire calls time out to let you know that he’s changing the rules of the game. And get this—the rules are now in favor of the other team.

Who does that? Well, Uncle Sam essentially did that when the SECURE Act was approved and signed into law in late December of 2019.

You probably have several clients who have named non-spousal beneficiaries to their retirement accounts. They’ve worked hard to save for retirement, and now—with good intentions—they want to pass a legacy on to their heirs.

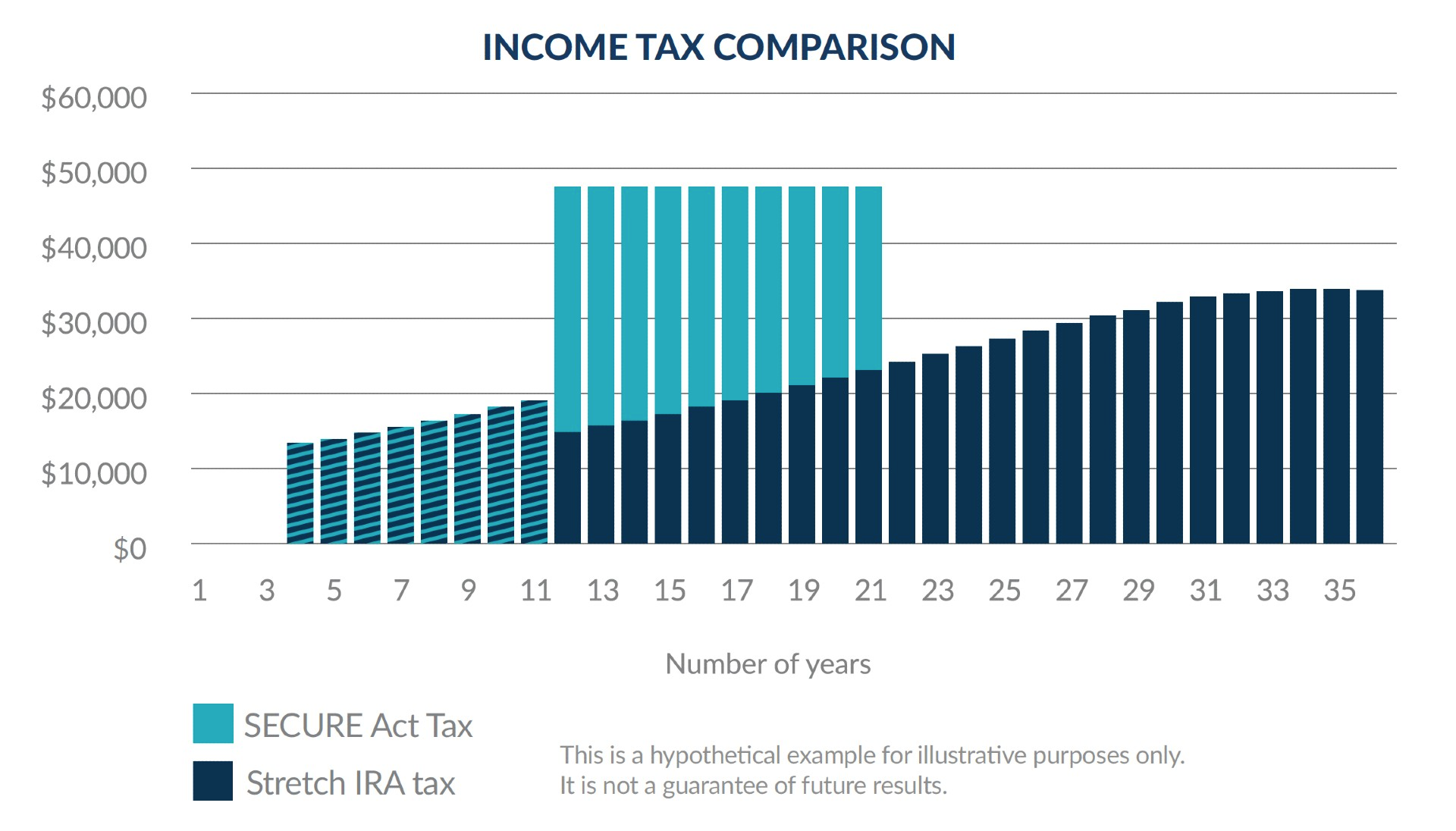

Before the SECURE Act, when non-spousal beneficiaries inherited an IRA, they were usually able to take required minimum distributions (RMDs) over the course of their life. This approach, commonly known as the “stretch IRA,” enabled them to defer income taxes (and minimize the impact of taxes) over their lifetime.

But then the rules changed in the middle of the game, as the SECURE Act eliminated the stretch provision. Now, most non-spousal beneficiaries of inherited IRAs will likely be forced to take RMDs in a period of just 10 years—when many are at the height of their top earning years. This could bump them into a higher tax bracket. What was once your client’s legacy is now a major headache for unprepared beneficiaries.

Visualize the impact: A hypothetical example

Let’s say your client, Meg, age 80, is widowed and passes away. She leaves her traditional IRA to her daughter, Karen, who resides in California. The inherited IRA account balance is $1 million at the time Meg dies.

If Karen inherited the IRA in 2019 before the SECURE Act took effect, she would be able to stretch distributions over her lifetime. This extended timeframe would’ve resulted in much lower taxes for Karen.

But Karen inherits the IRA in 2021. She only has 10 years to draw down the account, which creates a massive tax liability in Karen’s peak earning years, with retirement just around the corner.

Tackle the wealth transfer dilemma

At this point, you’re probably wondering how you can help clients get ahead and proactively solve for this. Lucky for you, we have a live webinar coming up that will do just that! Save your spot now

Can’t make the webinar? Download our essential SECURE Act advisor guide. Then call us at 866.866.7050 ext. 2. A dedicated Sales Development Advisor will walk you through out-of-the-box planning methods designed to provide powerful tax-advantaged living benefits and a tax-free death benefit.

FOR ADVISOR USE ONLY