Down and out: How demutualization impacts whole life dividends

In late March 2021, Constellation Insurance Holdings, a New York holding company, announced that it had cut a $1 billion deal to acquire Ohio National, then a 112-year-old insurance mutual company. As a result of the acquisition, Ohio National would demutualize—meaning that existing policyholders were paid for their ownership stake. Ohio National would then become a stock company owned by shareholders.

This got me thinking about Ohio National’s whole life policy dividends. How does demutualization impact dividends?

Determined to find answers, I identified a few other carriers that had demutuatlized within the past 30 years—specifically AXA/Equitable (1997), MetLife (2000) and John Hancock (2000). As you might have imagined, demutualization is not encouraging for policyholders that rely on dividends.

Comparing dividend rates

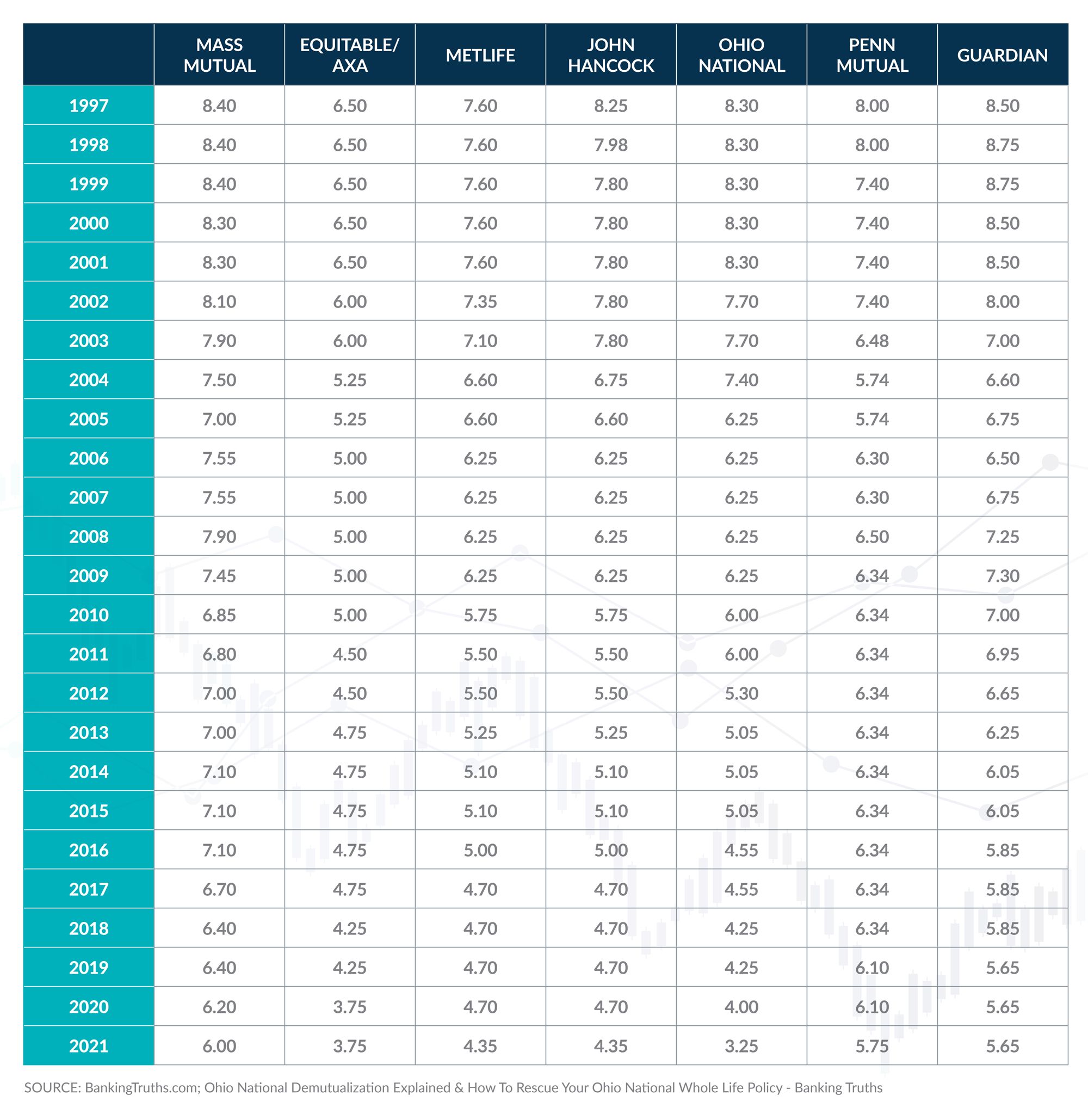

Let’s look at John Hancock’s whole life dividends before and after demutualiziation. Before 2000, the carrier was paying a robust 8.25%. Fast forward to today, and the dividend is a measly 4.35%. Now I’ll admit, all dividend rates have declined over the years, regardless of whether the carrier is owned by policyholders or shareholders. But you can’t ignore that mutual companies are paying materially more than stock companies. Just take a look at the table below and you’ll see how the stock companies (Equitable/AXA, MetLife, John Hancock and Penn Mutual) compare to Mass Mutual, Penn Mutual and Lafayette Life. Here you notice that dividend rates of demutualized companies have decreased at a faster rate than mutual carriers.

Why is this? Stock companies have to answer to Wall Street, while mutual companies are owned by those who own policies. Mutual companies can have longer investment horizons; stock companies are worried about next quarter’s earnings call.

What’s an advisor to do?

The next question is: What can you do as an advisor to help create better outcomes for clients? If you’re a fan of whole life, it’s imperative to compare current and historical dividend rates paid by stock companies versus those paid by mutual companies. Do your due diligence and consider other types of life insurance products that offer flexibility, growth potential and transparency, such as indexed universal life (IUL). For clients in good health who are looking for accumulation, tax advantaged income and/or death benefit, it may make sense to do a 1035 from a whole life policy to IUL.

You don’t have to figure it out on your own. You can rely on the Peak Pro team to dig into the case and provide the level of expertise and support you won’t find elsewhere. Give us a call at 866.866.7050 ext. 2, or email me directly at patrick@peakprofinancial.com. Let’s do better for your clients.