Truth hurts: Going beyond Roth conversions

What’s easy for advisors isn’t always the right thing for clients

This is a true story.

An RIA had $1 billion in assets under management. Its largest client had died recently.

The RIA had failed to institute any tax mitigation strategies.

The client’s estate ended up paying over $40 million in income and estate taxes at death.

It only gets better…

Being an ultra-high-net-worth client and primary source of referrals for the organization, this sent a shockwave throughout the firm’s client base. Ever since, the RIA has been in retention mode, scrambling to implement tax and estate planning strategies that align with the level of clientele they serve.

This takes the proverbial adage of “up the creek without a paddle” and removes the rudder, bow and sea worthiness of the boat.

What differentiates you in the eyes of your clients?

This begs the questions: What real value do you bring to your clients? What separates you from everyone else? What can you provide that is new, unique and different—so you can attract the type of client you want, retain them for life—and turn them into evangelists who rave about the value you bring to their lives?

Think about the biggest challenges high-net-worth clients age 55+ face. Taxes are at the top of the list. Whether we want to admit it, most traditional wealth managers and financial advisors don’t have the right tools and expertise to proactively minimize the impact of taxes, especially when it comes time to take distributions from qualified plan assets or pass them on to loved ones.

Meanwhile, clients are forced to rely on their CPA for tax guidance. Most CPAs are tax historians who are simply trying to survive tax season. They usually don’t have time to dig into each client’s scenario; instead, they focus on the task at hand (tax returns based on historical data)—not real-world solutions designed to help reduce future tax bills.

What is the typical sage advice when it comes to mitigating tax risk?

No matter how good we are at managing investments, we cannot predict or control the market. Nor can we control tax rates.

We can use, however, basic logic and assume taxes will increase. Knowing this, what do most advisors use to mitigate tax risk on retirement assets? They default to the almighty Roth conversion, of course.

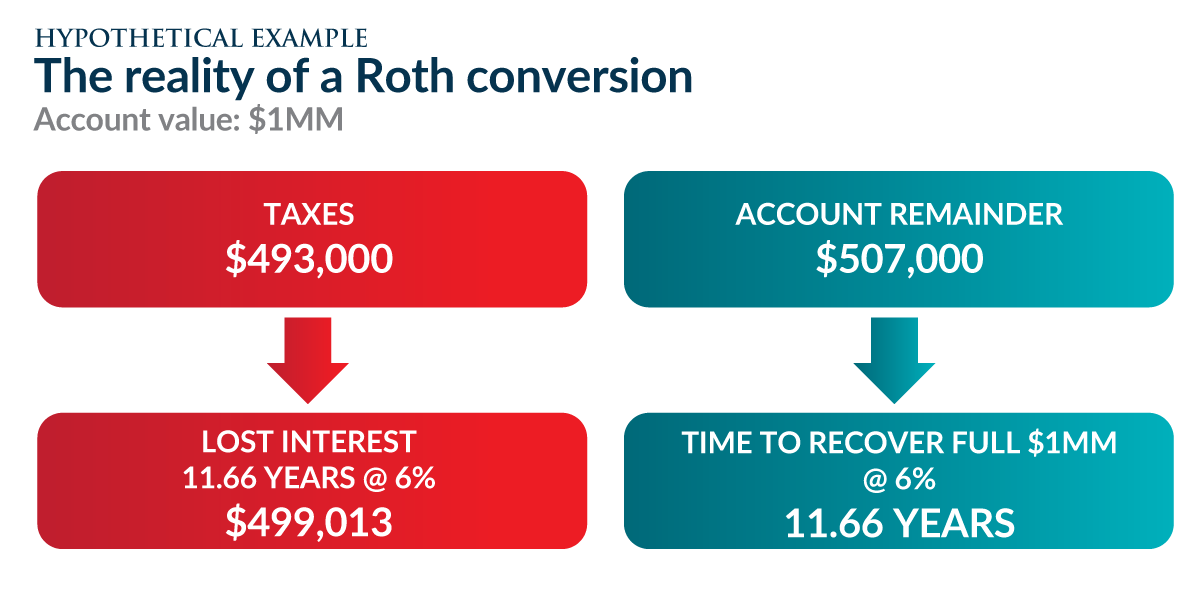

The truth is that a Roth conversion is not always the answer. For one thing, clients are stunned with a hefty tax bill and immediate drop in the account value. Some may have enough time to make up for the loss and bet on the market, but those aren’t sure things. It could take 12 years or more to recoup all the losses.

Whether your clients need the money for income down the road or are so financially well off that the IRA feels like a pair of cement boots, that would make the Roth an anchor with a chain.

With a conversion, clients lose interest earning power on the portion paid to Uncle Sam. There are other downfalls—that a Roth IRA is includable in a client’s estate—but we’ll save those for another day. The point is that any advisor can do a Roth conversion. What can you offer that may be a smarter alternative to Roth conversions—and a better fit for clients? Tackling this question can be the missing piece to solving prospecting, retention and attrition woes.

A smart alternative to Roth conversions

My team, Peak Pro Financial, works with the nation’s top 3% of advisors every day (and now, that RIA I mentioned at the beginning of this article). The concept that is helping these advisors move the dial for clients is a tax-advantaged alternative to the Roth conversion.

With this strategy, they’re able to convert taxable IRAs and qualified plan assets to the tax-free side of the ledger. When done properly with the right support and due diligence, in most cases, clients aren’t paying taxes out of pocket. Nor do they give up interest earning power on taxes paid. In fact, they earn interest on income taken.

How many clients do you have right now who would benefit from this concept? And if affluent prospects knew you had this strategy, how many would be knocking down your door to learn more?

The Roth conversion alternative is simple. As an alternative asset class, it is a low-cost, properly structured, indexed universal life insurance (IUL) policy.

Real-life example: Roth conversion reality versus alternative asset class

Take a case we recently worked on with an advisor. His client, Keith, is age 60 and resides in California. He has amassed $3 million in qualified plan assets, and is in the 37% federal and 12.3% state income tax brackets.

Keith asked the advisor about converting a third of his qualified assets to a Roth IRA. His main goals were to eliminate RMDs, reduce taxes over the long term and maximize retirement income.

The advisor called us to walk through the case to see if another option may be a better fit for Keith. After learning about the client’s goals and situation, we suggested repositioning 30% of qualified plan assets ($1 million) to IUL.

Here’s why. With a Roth conversion, Keith’s account value would immediately dwindle to $507,000. He would also lose earning potential on $493,000 that he would pay in income taxes. Think about how long it would take and the level of market risk required to recover.

So what’s the alternative? By repositioning qualified assets to a properly designed IUL, assuming historical index returns, Keith would pay $0 out of pocket for income taxes. He wouldn’t lose interest earning power on the conversion taxes. Plus, he would be able to take advantage of arbitrage—which gives Keith the opportunity to earn interest on income he takes from the IUL.

To help Keith achieve even greater peace of mind, flexibility and control, an IUL would also provide a “buffer” during market downturns. This gives Keith the option to tap into the IUL for income during down market years—and then when the market rebounds, he can take distributions from his equities portfolio.

The big picture: Becoming a true fiduciary

Wealth manager, financial advisor, investment manager—however we define ourselves—if we’re true fiduciaries, clients look to us to build the right plan based on their personalized needs and goals.

Identifying asset classes and diversifying clients’ investment portfolios are central to growing wealth. That’s how many advisors promote themselves and claim they’re “different” from the pack.

But let’s face it. The competitor down the street is most likely using similar, if not the exact same, model portfolios, investments, planning methods and software as everyone else. You’re likely playing “client ping-pong” with the same competitor—trading clients and creating a never-ending cycle that is downright tiring.

Advisors are always searching for the golden goose. Whether your clients are selling a business, looking for ways to remove retained earnings, or seeking a tax-smart retirement, the golden goose has already laid its eggs.

The Roth conversion alternative is one of several powerful strategies that can help enhance your planning approach. You may have a client looking for capital gains bypass solutions—or perhaps a successful couple that does not need all of their retirement assets for lifestyle purposes. They may be looking for a tax-advantaged way to pass qualified assets to beneficiaries. There is a slew of unique strategies that when designed the right way, can minimize—if not eliminate—taxes.

The point is that 21st-century fiduciaries must think outside the box and collaborate with the right experts to grow their business, especially in the age of artificial intelligence, big data and consolidation. By managing both assets and liabilities—and leveraging tax code to your advantage—you can finally stand out from competitors and do better for clients. By diversifying your toolbox, you can be the true fiduciary your clients rely on.