Your last wake-up call: Breaking down the lunacy of the current stock market

Today’s stock market is nuts.

Over the past six months, I’ve highlighted just how crazy it is in webinars and countless conversations with advisors.

I’ve sourced graphs, tables and hard data from reputable sources. But I recently stumbled across the most telling graph to describe the pure lunacy of the current market. Check it out

Hyped on hope: What are your clients really investing in?

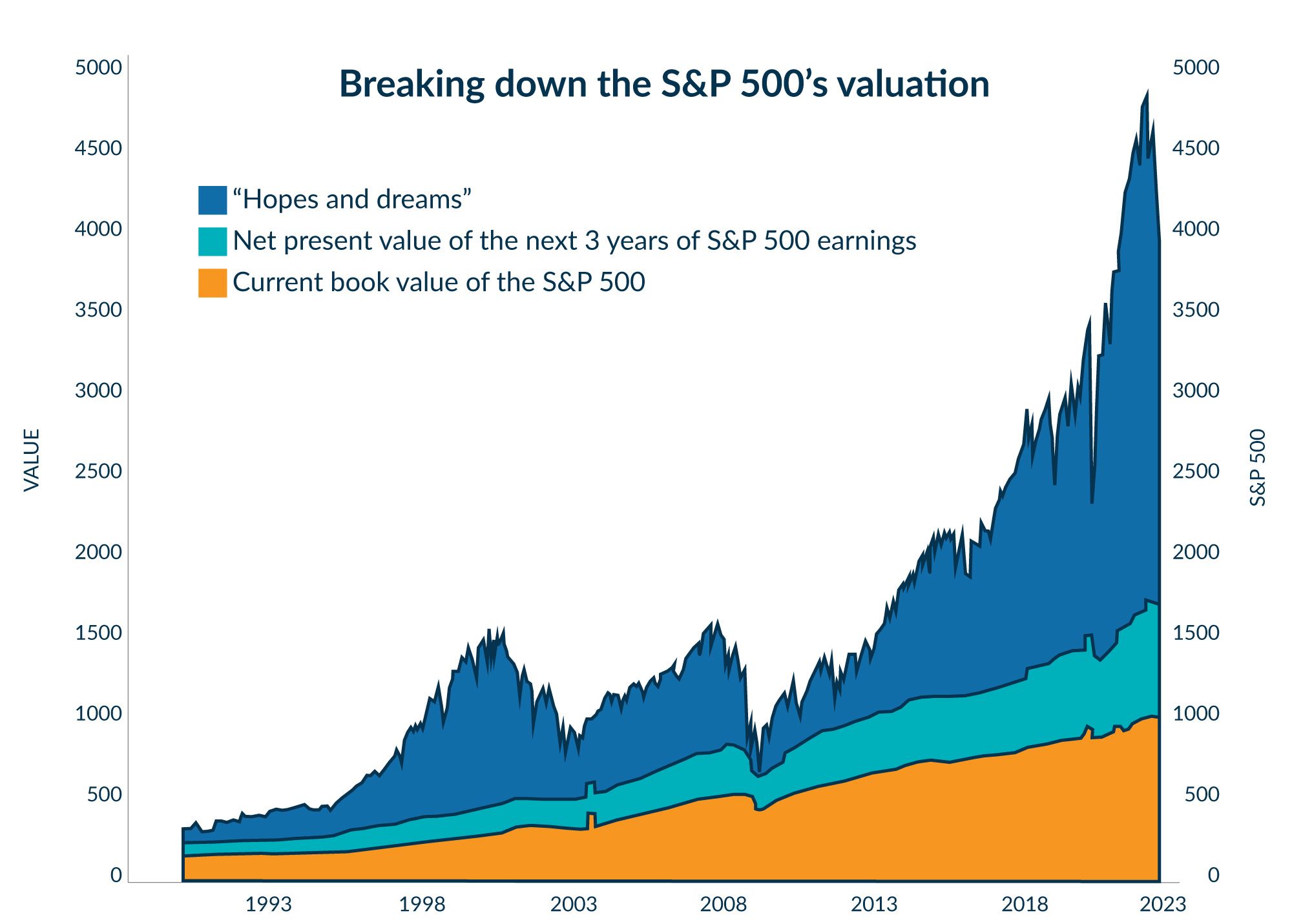

This chart does a great job of demonstrating how the percentage of each dollar spent on buying the S&P Index has shifted over time.

In the ‘90s, you can see that the book value, the earnings that were between one and three years out and the earnings that were greater than three years out—are all roughly a third of the amount of the price you paid when you bought a share of the S&P 500.

Today, the amount allocated to the book value and the earnings between years one and three is dwarfed by the amount allocated to the earnings further down the road.

What does this mean for your clients and your practice?

When such a large percentage of the purchase price of a share of the S&P 500 is “buying” things that are significantly less certain than the book value, doesn’t that cause investors to incur greater levels of risk?

Also, look at what happened to the value of the “Hopes and dreams” in 2008. While the book value and the earnings less than three years out declined, they did so at percentages that were much smaller than the “Hopes and dreams” portion.

So, here’s the question to ask as yourself as an advisor. What kind of reduction would we see in the “Hopes and dreams” portion of the S&P based on current levels? Can your clients afford to risk their retirement based on wishful thinking?

It’s time to wake up and get real. The future of your practice can’t rely solely on hopes and dreams. 21st century advisors—those who hare armed with innovative strategies to help clients survive and thrive in unprecedented circumstances—will prevail. And further differentiate themselves from the growing pack of dinosaurs.